reverse tax calculator ny

Enter the sales tax percentage. Download this app from Microsoft Store for Windows 10 Windows 81 Windows 10 Mobile Windows Phone 81.

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator - 100 Free - Calculatorsio.

. Enter the total amount that you wish to have calculated in order to determine tax on the sale. 805 cents per gallon of regular gasoline 800 cents per gallon of diesel. It determines the amount of gross wages before taxes and deductions that.

Sales tax amount or rate. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

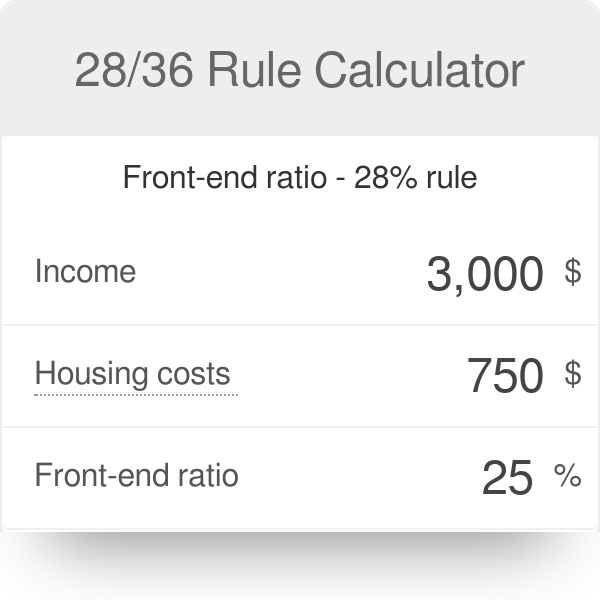

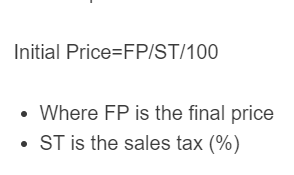

Reverse Tax Calculator 2021-2022 This valuable tool has been updated for with latest figures and rules for working out taxes. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Overview of New York Taxes.

Following is the reverse sales tax formula on how to calculate reverse tax. The combined rate used in this calculator 8875 is the result of the New York state rate 4 the New York City tax rate 45 and in. In New York such a reverse mortgage is called a proprietary reverse mortgage and is made pursuant to New York Real Property Law Section 280 or 280-a.

Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. Order Now Offer Details. New York Tobacco Tax.

On the other hand many products face higher rates or additional charges. See screenshots read the latest customer reviews and compare ratings for Reverse Tax Calculator. For example total cost is 118 i need a help for the formula to work back 10099118.

Use this federal gross pay calculator to gross up wages based on net pay. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

The 10012 New York City New York general sales tax rate is 8875. This is the after-tax amount. Reverse sales tax calculator ny Monday March 7 2022 Edit.

You are able to use our New York State Tax Calculator to calculate your total tax costs in the tax year 202122. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. New York Sales Tax Calculator Reverse Sales DrEmployee.

Enter the final price or amount. Now I want to calculate the tax from the total cost. Amount without sales tax QST rate QST amount.

In New York City there is an additional 150 excise tax per pack of cigarettes. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. The term Jumbo Reverse Mortgage is used to refer to a reverse mortgage that allows a borrower to borrow more than the maximum amount allowable under the HECM program.

New York Property Tax. There is also a supplemental withholding rate of 1170 for bonuses and commissions. Living in New York City adds more of a strain on your paycheck than living in the rest of the state as the Big Apple imposes its own local income tax on top of the state one.

New York has a 4 statewide sales tax rate but also has 988 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4229 on top. Us Sales Tax Calculator Reverse Sales Dremployee A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Calculating taxes in New York is a little trickier than in other states.

Amount without sales tax GST rate GST amount. Enter the final price or amount. It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income.

New York Payroll Taxes. It is very easy to use it. The state sales tax rate in New York is 4000.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. How 2021 Sales taxes are calculated for zip code 10012. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you.

Instead of using the reverse sales tax calculator you can compute this manuallyTo find the original price of an item you need this formula. The harmonized sales tax or hst. Cigarettes are subject to an excise tax of 435 per pack of 20 and other tobacco products have a tax equaling 75 of the wholesale price.

This app is especially useful to all manner of professionals who remit taxes to government agencies. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. As well as entrepreneurs and anyone else who may need to figure out just how much of their sale should be recorded as tax.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Tax reverse calculation formula. Choose which one you are using in the drop-down.

Enter either the sales tax amount in dollars such as 10 for 10 or the sales tax rate such as 85 for 850. Depending on the zipcode the sales tax rate of New York City may Find your GSTHST rebate for a new home. You obviously may change the default values if you desire.

The state as a whole has a progressive income tax that ranges from 4 to 109 depending on an employees income level. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New York local counties cities and special taxation districts. Instead of using the reverse sales tax calculator you can compute this manually.

Here is how the total is calculated before sales tax. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Enter the sales tax percentage.

I have a product used to sell for 118 which includes value of the product is 100 9 of CGST tax 9 of SGST tax which equals 10099118. You will need to input the following.

Reverse Sales Tax Calculator 100 Free Calculators Io

New York Paycheck Calculator Smartasset

Mortgage Calculator The Upshot Rent Vs Mortgage Calculator From The New York Times Mortgage Amortization Calculator Online Mortgage Mortgage Calculator Tools

Will I Outlive My Money Consider A Reverse Mortgage As Part Of Your Retirement Strategy Retirement Strategies Reverse Mortgage Investing For Retirement

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Reverse Sales Tax Calculator Calculator Academy

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Merchants Online 2021 Best Merchant Services Provider Merchant Account Merchant Services Accounting

Fha Reverse Mortgages Hecms For Seniors Purchase Or Refinance Mortgage Payoff Reverse Mortgage Mortgage Loans

Comparison Of Common Loan Programs Conventional Fha And Va Loans Closedis Va Home Loan Watch This Before A Va Loan Refinance Mortgage Conventional Loan

Heritus Mortgage Live Transfers Mortgage Loan Company Mortgage Loan Officer

Stocks Continued To Improve Again Today The Djia Up Over 200 Points At One Time Before Slipping Back Som Home Improvement Loans Stock Exchange How To Get Rich

Reverse Sales Tax Calculator Calculator Academy

New York Sales Tax Calculator Reverse Sales Dremployee

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Pennsylvania Closing Cost And Mortgage Calculator Mortgage Calculator Online Mortgage Mortgage